Background

Health care costs are outpacing inflation, taking bigger and bigger chunks out of Californians’ incomes and wages. More than half of Californians say they skip or delay care due to high costs. A major driver of these rising costs are health care mergers. As health systems and other health care corporations get bigger, they often drive-up prices for consumers, and studies show this consolidation does not come with improvements in quality and can even lead to less access to care. While health care consolidation is an issue across the board, in the last decade specific issues have arisen around patient care and price hikes with respect to private equity and hedge funds acquisitions—particularly as they have accelerated their investment and takeovers of health facilities and physician organizations. This has been happening with little regulation or oversight.

AB 3129 by Assemblymember Wood will extend the California Attorney General’s oversight authority to private equity and hedge fund acquisitions that result in changes in control of health facilities and groups of physicians and other health professionals. As private equity’s role in health care grows and health care costs continue to skyrocket, this bill will give the Attorney General authority to act on behalf of consumers to protect access to affordable and quality health care when these transactions

are proposed.

Quick Profits for Private Equity at the Expense of Patients

Robust research shows that health care mergers and takeovers do not improve quality or equity, but instead drive higher prices for care.i The same is true for private equity takeovers of skilled nursing homes, hospitals and physician groups, but with particular danger to consumers due to private equity’s goal of maximizing profit, treating it the same as any other profit-maximizing opportunity. Private equity acquisitions in health care have accelerated, with health care acquisition spending reaching $200 billion in 2021 alone, and $1 trillion in spending over the last decade.

Fund managers and their investors often have little knowledge of health care, and aggressively pursue quick profits, with higher risks for the patients served by the health care entity they take over. For example, private equity firms will take out loans using health care facilities as collateral, and then pay back investors, but leave the health care facility saddled with the debt. If the health care entity is left with high levels of debt from leveraged buyouts, that can increase the risk of bankruptcy—with dire consequences for the community served if services are lost.ii Unfortunately, there have already been examples in other states of private equity-owned hospitals and physician practices closing their doors and shuttering services both in rural and urban areas—leaving underserved communities with few or no alternatives for accessing care.iii

Higher Prices and Worse Outcomes for Patients

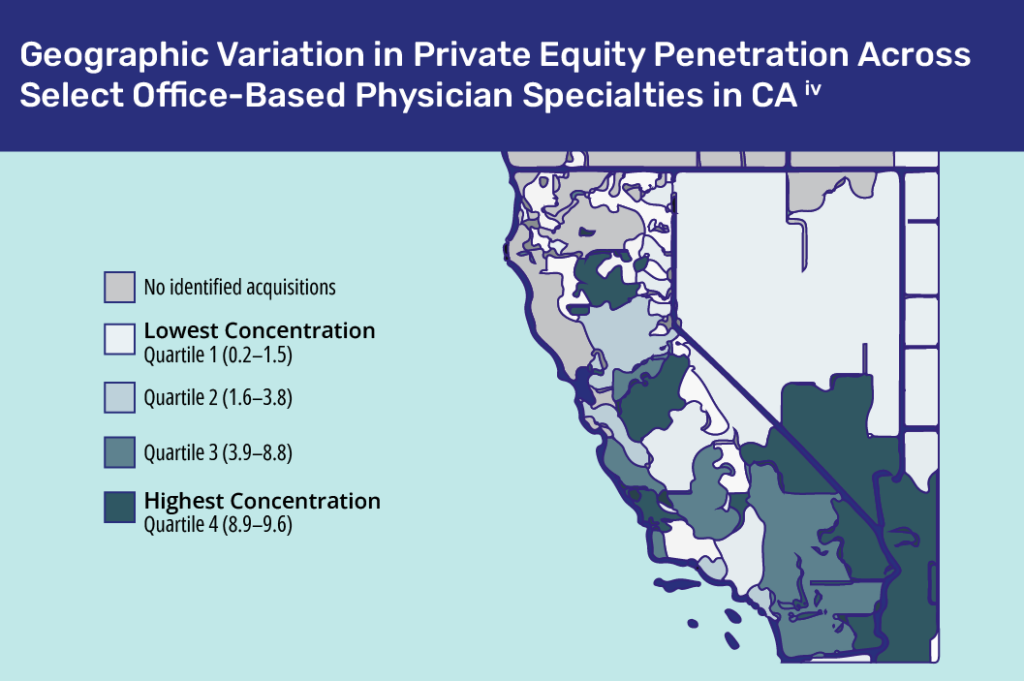

As private equity firms and hedge funds buy up local hospitals, skilled nursing homes and doctor’s offices, patients pay higher prices and often receive lower quality care, and even experience higher death rates. Private equity firms increase their market power by acquiring multiple providers in the same specialty within a local or regional market and then use their market power to raise prices. California already has regions with a high percentage of private equity-owned physician practices.iv Less competitive pressure can result in lower quality and negative health outcomes.v

Consequences of Private Equity Takeovers

Higher prices

One study found that private equity acquisition of physician practices leads to price increases ranging from 16% in oncology to 4% in primary care and dermatology. In communities where private equity dominate physician specialties compared to other U.S. markets, price increases are up to 3 times higher.

Dangerous health outcomes

Very concerning research has shown the dangerous impacts of private equity acquisitions on health care. Private equity ownership was found to increase death rates of patients with Medicare coverage by 10% in nursing homes.viii Another recent study found that private equity ownership in U.S. hospitals was associated witha 25% increase in hospital acquired conditions, avoidable illnesses and injuries including falls and central line-associated infections. This persisted for three years after the acquisition.vii

Reduced access

When seeking a quick profit, private equity firms will flip the asset by selling their newly purchased health care organization to another buyer like CVS or Amazon, for a much higher price. To attract those buyers, the private equity firm must boost the organizations’ profits, by cutting costs, raising prices or increasing the number of profitable services provided, and cutting unprofitable services—even if those services are needed in a community.

AB 3129 Protects Patients through State Oversight of Private Equity in Health Care

For over 30 years, California Attorneys General of both parties have used their authority to protect consumers from negative impacts of nonprofit hospital mergers. Right now, the Attorney General provides this public scrutiny when nonprofit hospitals merge, but not when a hedge fund is acquiring a hospital or nursing home, no matter how great the danger of worse care, less access, higher costs, or all three. AB 3129 (Wood) extends the current authority of the Attorney General, allowing the Attorney General to provide public scrutiny of these private equity and hedge fund acquisitions and changes in control of hospitals, skilled nursing facilities, and physician groups.

Under AB 3129:

- The Attorney General can approve, deny or approve the acquisition with conditions to protect consumers from negative impacts on access to and quality of care, as well as price hikes.

- The Attorney General will undergo a 90-day review process and evaluate these transactions for their impacts on competition and access or availability of health care services in the community, and the public interest.

- The public has a voice in these transactions, as the bill allows the Attorney General to hold public hearings about the acquisition in the impacted communities.

- Financially distressed health facilities and physician groups can apply for a waiver from the review. The Attorney General will consider the impacts of the acquisition on the community and health care market when deciding whether to grant the waiver.

State oversight will protect consumers’ health and the public interest when private equity and hedge funds propose these acquisitions in our health care system.

Endnotes

ii. Private Equity’s Role in Health Care (The Commonwealth Fund, 2023)

viii. Private Equity’s Role in Health Care (The Commonwealth Fund, 2023)